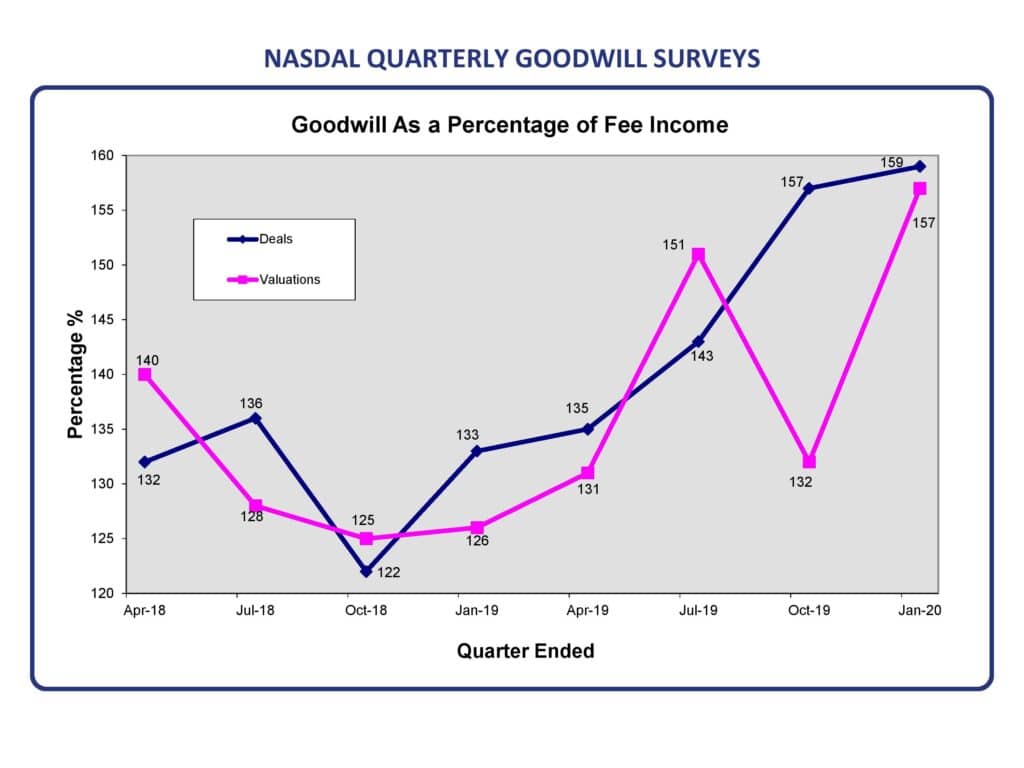

The latest NASDAL Goodwill Survey is very interesting when you dig behind the graph.

The headline shows this as the fifth consecutive quarter when deal values have risen – which I am completely in agreement with. This experience mirrors that of Frank Taylor & Associates who continued to have deals progress and complete in 2020 despite the pandemic. There was an expected lag with some deals stalled for a number of months, but they still made it to completion.

Across the board, so NHS, private and mixed income practices higher goodwill values and sale prices and this is easily explained.

The NASDAL survey covers the whole market and as the commentary highlights many sales do not have an open market valuation. These are deals where the seller is approached by a corporate buyer or a private sale with no valuation undertaken or broker involved.

Frank Taylor & Associates undertake a considerable number of goodwill valuations and 99% are for the open market, as such my own data consistently shows higher valuation and deal percentages than the NASDAL survey. The general trends are agreed on though and this quarterly survey is a great resource to track the general movement in the market.

The difference between selling privately, be it to a corporate or any other buyer, can be stark. Typically, the reduction in the sale price would be 10-30% of the goodwill value. So, on an average practice value of £700,000 this could be lost goodwill value up to £210,000.

In the latter part of 2020, a dental practice was sold direct for in excess of £400,000 below market value. This one deal alone with skew the figures considerably and it is not a lone example. I appreciate that for some the sale price is no the only driver, but the commercial terms should bear some resemblance to an open market deal.

(Author – Andy Acton)